Facing approval delays? Learn how AP invoice approval software can speed up approvals, customise invoice approval workflow, and improve visibility in your approval process.

Chasing invoice approvals is no one’s idea of meaningful work.

Yet many Accounts Payable (AP) professionals like you spend 20% (or more) of their week nudging approvers, digging through email threads, and wrestling with paper trails.

Sound familiar? This old-school way of working doesn’t just drain your time, it invites errors, delays, compliance headaches, and puts your supplier relationships at risk. This becomes worse when your invoice volume grows.

But there’s a better way. AP invoice approval software cuts through challenges, replacing bottlenecks with a clear, efficient workflow that puts you back in control.

Here are 5 key benefits of adopting AP invoice approval software in your finance function.

What are the benefits of an invoice approval software?

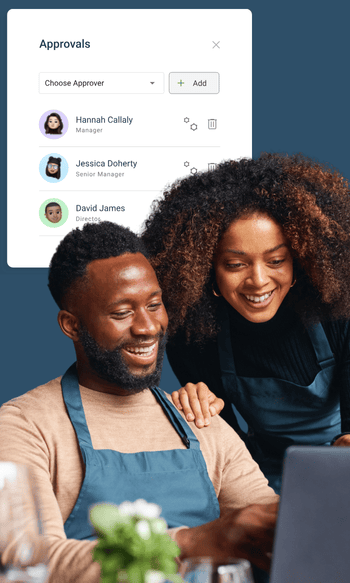

1. Automated Routing of Approvals

Think of this: An invoice lands on your desk, or worse, in your already overflowing inbox. You’re not sure who will approve it, so you send it off to someone who might be the right person. Days pass. Silence. Eventually, it returns to you with a “Not me, try XYZ.” Meanwhile, the supplier is chasing payment, and you’re chasing people.

Now, imagine a different situation.

The moment the invoice arrives, your AP automation system recognises it. It knows the invoice is from your supplier, so it automatically sends it to the correct approver. As soon as they sign off, it flows seamlessly to the next person in the chain, without you lifting a finger. No confusion, no bottlenecks, no policy breaches. Just a smooth, rule-based journey from inbox to paid. Moreover, digital routing eliminates the risk of misplaced or overlooked paper/email invoices.

That’s the power of AP automation, managing your daily approval workflow.

2. Approval Reminders

Even with the smartest routing in place, there’s always that one approval that goes quiet. Maybe the approver’s on leave. Maybe it got buried under a mountain of emails. Either way, your invoice is stuck, and so are you.

Your automated invoicing system steps in when the approver doesn’t approve on time. The system gently nudges them with an automatic reminder. No awkward emails from you. No spreadsheets to track who’s holding things back. Just a time-stamped alert, straight from the software, reminding them to take action.

You stay in control, with complete visibility into who received what and when. And your finance team reclaims hours of lost time because reminders aren’t a task anymore.

3. Customised Approvals

3. Customised Approvals

Your business is growing fast. You have more suppliers, bigger budgets, and invoices that once needed one signature, but now need two or three. Suddenly, your once-simple approval process starts to creak under pressure. Emails fly, people get looped in late, and approvals get missed. And the risk? It grows right alongside the business.

With AP automation in place, your workflows grow with you without the chaos. High-value invoices are automatically escalated to senior managers or finance leaders, so there is no need for anyone to remember who should approve what. The rules are built-in, the governance is tight, and nothing slips through the cracks.

Even better? Approvals don’t grind to a halt just because someone’s out of the office. With mobile access, managers can approve invoices on the go, between meetings, from the airport, or wherever work takes them.

And when your structure changes again, updating your approval paths is quick, easy, and disruption-free. Your process stays sharp, no matter how big your team gets.

Trusted by 7,500+ businesses globally

Servicing businesses is what we do best. We have over a decade of experience working with businesses just like yours. We've helped finance teams reduce their invoice processing by up to 97% and get invoices approved 5 times faster

Read our customer success stories to see the data for yourself

4. Stronger Compliance and Audit Trails

4. Stronger Compliance and Audit Trails

Audits used to mean panic. Spreadsheets open and filing cabinets searched for that one approval email from three months ago. Who signed off on that invoice? When? Was there a change? And if so, where’s the paper trail?

With automated invoicing, when your auditor asks for the approval history of a high-value invoice, you click a few times, and there it is: every step logged, every approver listed with time-stamp. No guesswork, no stress.

With pre-set rules and workflows, every invoice follows your company’s spend policies, automatically. Every change, comment, and signature is tracked and stored in one secure, digital space.

And because everything is recorded and accessible, the risk of fraud or manipulation drops significantly. Instead of dreading audits, your finance team meets them with confidence. Automated invoicing software doesn’t just make your job easier, it protects your business, one digital trail at a time.

5. Increased Visibility and Control on Invoices

5. Increased Visibility and Control on Invoices

There was a time when trying to track an invoice felt like chasing a ghost. “Has it been approved yet?” “Who has it now?” “Did it get lost in someone’s inbox?” You were left guessing, refreshing emails, and hoping for the best.

But not anymore.

Now, you open your AP automation dashboard and see everything. Every invoice, every stage, every approver. You know what’s pending, what’s been approved, and what’s been rejected, all in one clear, central view.

Need deeper insights? You’ve got them. With a few clicks, you can spot approval trends, identify bottlenecks, and track supplier pricing to guide smarter budgeting. You can even control access with user permissions, so only the right eyes see the right invoices.

And the best part? When something’s off: a delay, a duplicate, or a suspicious pattern, you catch it early. No more surprises. Just full visibility and better decisions.

Final Thoughts

Final Thoughts

In a world where every minute and every dollar counts, knowing exactly where your invoices stand, anytime, anywhere, is a necessity. The right invoice approval software doesn’t just automate a process, it gives you control, clarity, and confidence.

By upgrading to automated invoicing, your finance team can stop chasing approvals and start focusing on strategy. You’ll save time, reduce costly errors, and put an end to late payment fees.

The future of AP isn’t buried in inboxes or lost in folders. It’s streamlined, smart, and just a tap away.

Other resources

EBOOK

Download our 5 Steps to Automating Your AP Function eBook for quick and actionable tips on a smooth implementation.

LIVE WEBINARS

Join our live webinar to see how Lightyear works to enhance AP processes across your business

Join our live webinar to see how Lightyear works to enhance AP processes across your business