Did you know that simple tax mistakes is costing UK businesses billions?

Relying on paper processes and submitting a single return once a year makes it easy for errors to slip through, errors that can snowball into serious financial discrepancies. In fact, HMRC estimates that avoidable taxpayer mistakes cost the Exchequer £8 billion annually, with VAT return errors alone accounting for over £3.5 billion in lost revenue.

But with cloud-based AP automation, you gain real-time financial data, helping you catch and correct mistakes before they escalate. You’ll also have the accuracy and visibility needed for better tax planning and seamless MTD compliance.

In this article, we will break down what Making Tax Digital (MTD) is and the 3 ways AP automation helps you stay compliant.

What is Making Tax Digital?

Keeping your tax records up to date shouldn’t be a hassle, and that’s exactly what Making Tax Digital (MTD) is designed to solve.

As part of HMRC’s initiative to become one of the world’s most digitally advanced tax administrations, MTD is transforming how businesses manage tax, making it more efficient, accurate, and easier to get right.

If your business is VAT-registered with a turnover below £85,000, you already have the option to file returns using MTD-compatible software, but soon, this won’t just be optional. From 6 April 2026, Making Tax Digital for Income Tax (MTD IT) will require your business to keep digital records and submit income and expense summaries quarterly using approved software.

This means you can say goodbye to manual processes and ensure you have real-time financial data at your fingertips, reducing errors and simplifying tax compliance. As a financial controller, this shift is something to prepare for now, ensuring your systems and teams are ready to embrace digital record-keeping and avoid last-minute compliance headaches.

What are the ‘making tax digital’ deadlines?

MTD for VAT phase I – HMRC rolled out the first phase of Making Tax Digital (MTD) in April 2019 for VAT-registered businesses. Initially, this requirement applied to businesses with a taxable turnover above the VAT threshold of £85,000.

MTD for VAT - In effect since April 2022. If you have a VAT-registered business, you must use MTD-compatible software to file VAT returns.

MTD for Income Tax – Starts April 2026. This applies to you if your annual self-employment or property income is over £50,000.

MTD for Income Tax Self Assessment – Starts April 2027. This applies to you if your annual self-employed business or property or property income is over £30,000.

MTD for Income Tax Partnerships – Details and start date to be confirmed.

MTD for Corporation Tax – Details and start date to be confirmed.

Role of Cloud-Based AP Automation in MTD

Role of Cloud-Based AP Automation in MTD

It’s time to get ahead of these changes by ensuring your financial systems are MTD-ready. Cloud-based AP automation simplifies this by digitising invoice processing, reducing errors, and keeping you compliant with evolving regulations.

1. Simplifies digital record-keeping

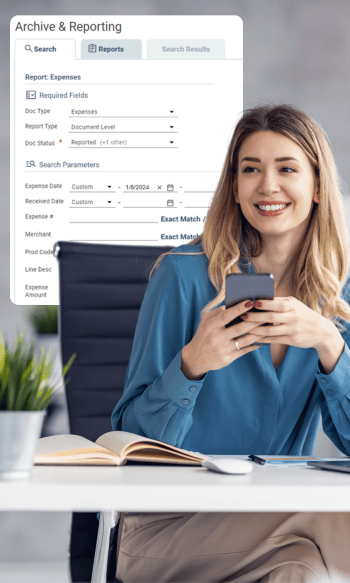

As a part of the finance team, you need complete visibility over your accounts, and AP automation makes that effortless. Instead of chasing paper trails, every invoice, receipt, and payment detail is securely stored in one searchable platform, giving you instant access whenever you need it. You can quickly check whether an invoice is pending, approved, or paid, reducing the risk of errors, delays, or forgotten payments.

With seamless integration into your existing accounting software, your financial data stays up to date, providing a clear and accurate overview at all times. Every invoice is correctly recorded and reconciled, minimising discrepancies in tax filings and ensuring compliance with MTD requirements. Plus, a fully digital audit trail of invoices and payments simplifies VAT reporting, making tax submissions more efficient and stress-free.

Trusted by 7,500+ businesses globally

Servicing businesses is what we do best. We have over a decade of experience working with businesses just like yours. We've helped finance teams reduce their invoice processing by up to 97% and get invoices approved 5 times faster

Read our customer success stories to see the data for yourself

2. Removes data entry errors

Manual data entry can be time-consuming and prone to errors, especially when it comes to VAT reporting. With AP automation, you eliminate the risk of typos, miscalculations, and compliance headaches by letting smart software do the tasks for you. AP automation software extracts data directly from invoices and receipts, ensuring accuracy and reducing the need for manual input.

It automatically applies the correct VAT rates and aligns calculations with HMRC’s MTD requirements, so you can be confident that your filings are correct. Plus, by removing these repetitive tasks, you free up valuable time to focus on more strategic financial priorities, like cash flow forecasting and budgeting, helping you drive better financial decisions for your business.

3. Provides real-time reporting

As a Financial Controller, you understand the importance of accurate financial reporting, especially when it comes to VAT. With an automated AP system in place, you ensure that the correct VAT is applied every time, reducing the risk of misreporting and compliance issues. This real-time reporting gives you greater financial visibility, enabling more accurate cash flow forecasting, tax planning, budgeting, expense tracking, scenario planning, and financial modelling.

With automated validation, any discrepancies are flagged early, minimising the risk of costly audits and ensuring that your financial records are always up-to-date. This allows your business to file accurate tax returns on time, giving you peace of mind and more control over your financial processes.

Final Thoughts

Final Thoughts

Other resources

EBOOK

Download our '5 Steps to Automating Your AP Function' eBook for quick and actionable tips on a smooth implementation process.

LIVE WEBINARS

Join our live webinar to see how Lightyear works to enhance AP processes across your business.

Join our live webinar to see how Lightyear works to enhance AP processes across your business.