What’s Really Causing the Chaos?

The Cost of Missing Invoices

Trusted by 7,500+ businesses globally

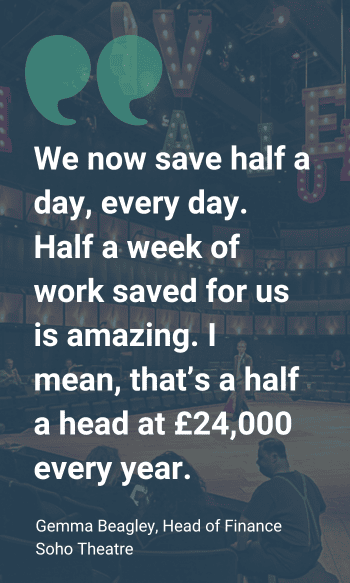

Servicing businesses is what we do best. We have over a decade of experience working with businesses just like yours. We've helped finance teams reduce their invoice processing by up to 97% and get invoices approved 5 times faster

Read our customer success stories to see the data for yourself

How Can You Fix the Problem?

How Can You Fix the Problem?

Final Thoughts

Final Thoughts

Frequently Asked Questions (FAQs)

Frequently Asked Questions (FAQs)

4. Will automation replace my AP team?

No, automation is designed to support your team, not replace it. It handles the repetitive, manual parts of the process so your team can focus on more valuable, strategic tasks.

5. How do I get started with invoice automation?

Start by assessing your current AP process and identifying where delays or errors happen. Then, explore invoice automation providers and use our free checklist to compare features and find the right fit for your needs.

Other resources

EBOOK

Download our 5 Steps to Automating Your AP Function eBook for quick and actionable tips on a smooth implementation.

LIVE WEBINARS

Join our live webinar to see how Lightyear works to enhance AP processes across your business

Join our live webinar to see how Lightyear works to enhance AP processes across your business