Quantifying the ROI

of Accounts Payable Automation for Clients

Quantifying the ROI of AP Automation For Clients

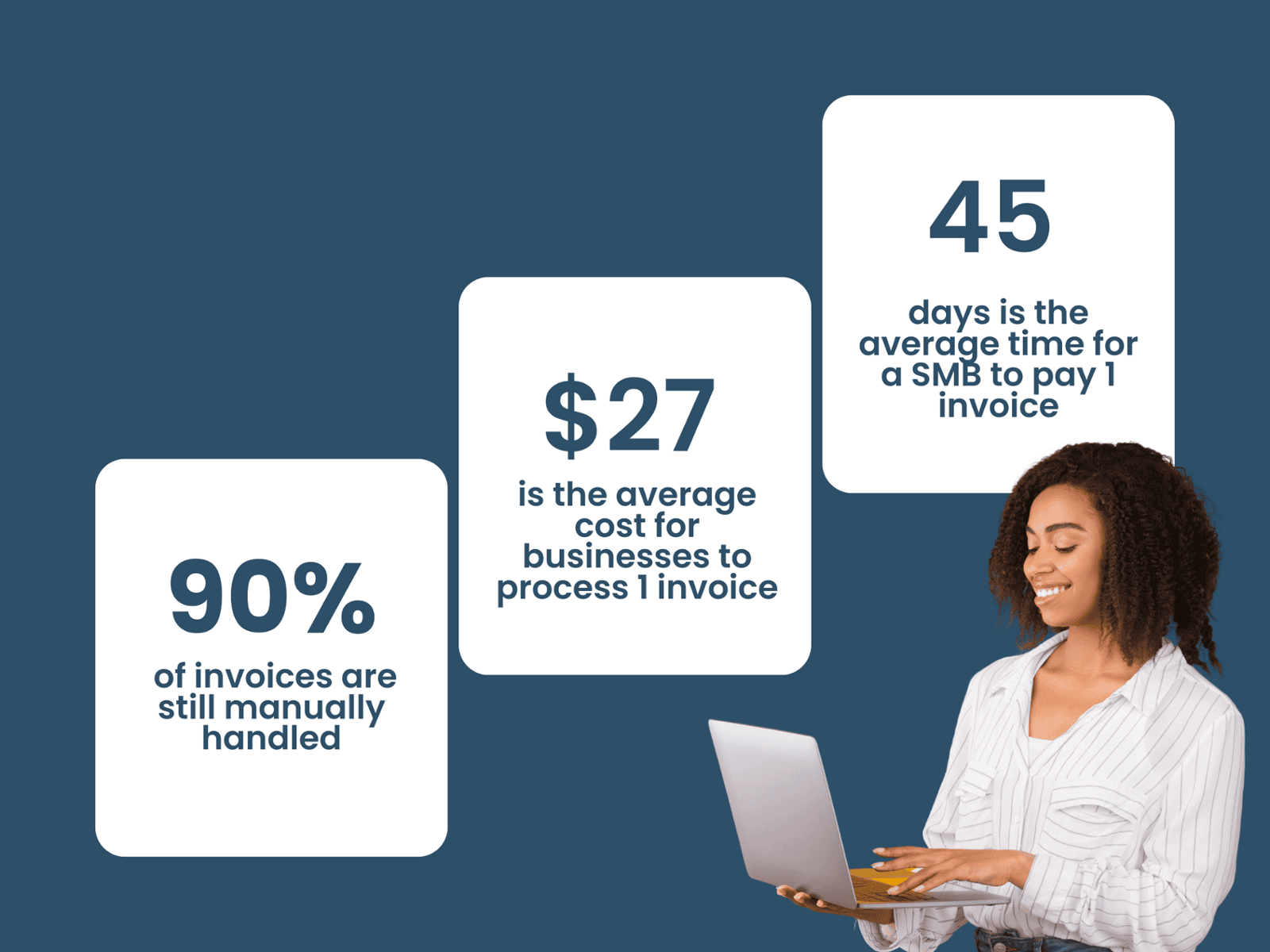

With a million and one things for businesses to spend their money on, and an ever increasing level of pressure to maintain profitability, splashing out on another business tool can seem like another unnecessary monthly expenditure for clients.

However, helping your clients to improve their AP processes could be largely beneficial for them. Neglecting this area can result in financial losses and decreased productivity beyond the AP department.

Let's take a closer look at a few areas where the return on investment from AP automation becomes evident:

1. Labour Costs

Many industries are currently facing labour shortages, making it difficult for businesses to maintain adequate staffing levels. AP automation, while not a replacement for human employees, can significantly ease the administrative burden on your clients. For example, Healthcare Ireland experienced a rapid business growth facilitated by the time-saving processes enabled through AP automation. Rather than being forced to hire staff purely to process AP data as they scaled, Healthcare Ireland could automate time consuming activities related to purchasing and invoicing, and support their existing staff in growing their roles within the finance department.

“We run the entire Purchase Ledger function for 24 Care Homes with two full time staff members. It means that we can save on labour costs and better support who we have in the team - I have purchase ledger professionals with over 40 years experience who can’t believe the difference it has made to their roles.”

- Barry Casey, Head of Finance Group at Healthcare Ireland Group

2. Preventing Incorrect Payments

By supporting your clients in their transition to digital AP processes, a long term return on investment can be found in eliminating paper. Not only the literal cost of paper, but also because paper related errors are reduced, which can be costly and frustrating for clients. No more double payments, no more incorrect product amounts or prices and no chance of fraudulent or incorrect payments - AP software spots and prevents it all when invoices are digitised.

“Paperless AP processes means that nothing can get past us in finance now, everything gets put through the system and we choose what gets approved and paid and what doesn’t.”

- Claire, Head of Finance at Ulster Rugby

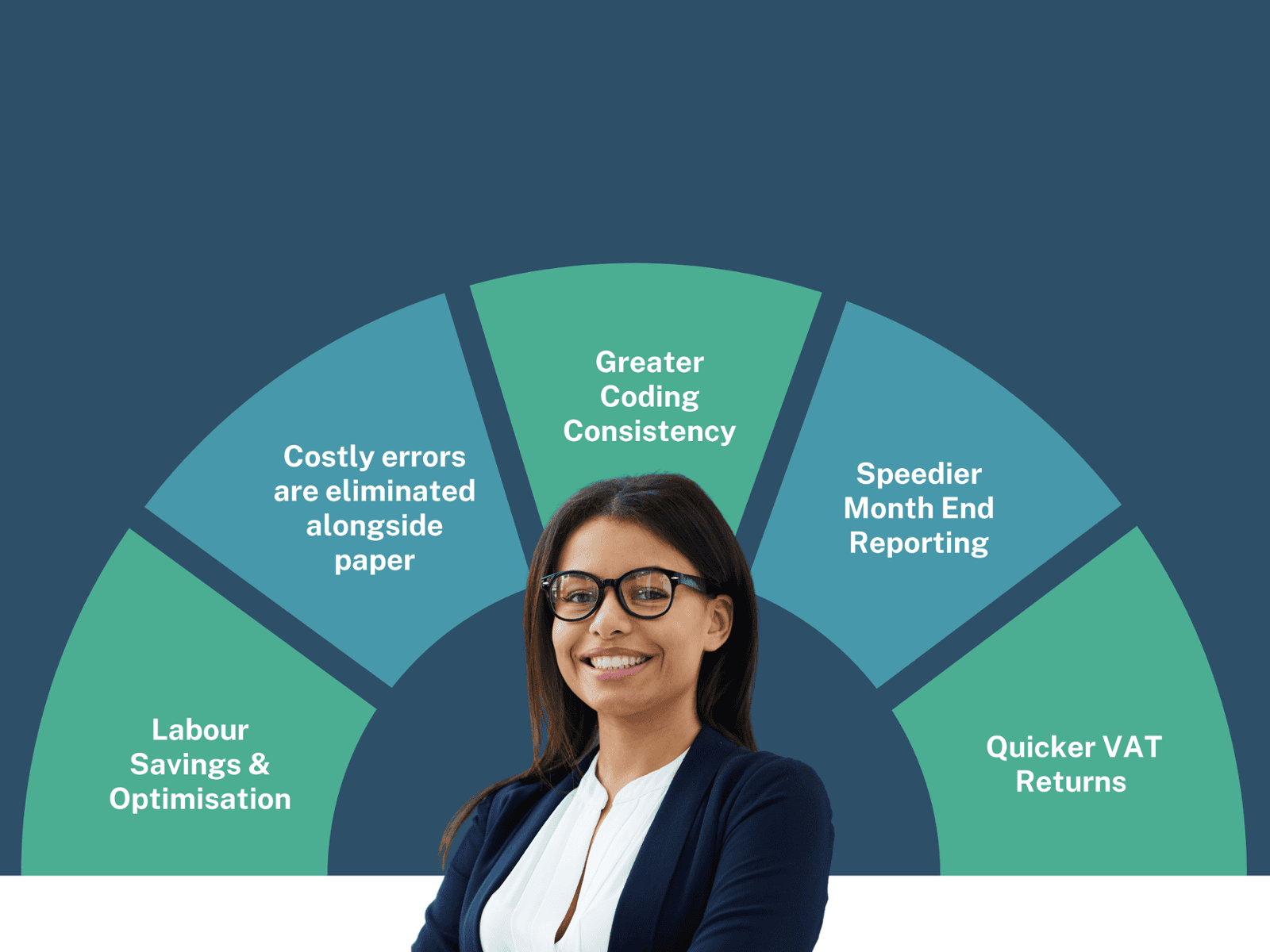

3. The Benefits of Consistent Coding

4. Speedier Month End Reporting

5. Faster VAT Returns

5. Faster VAT Returns

AP automation supports quicker turnaround times for monthly or quarterly VAT returns. With instant access to data that is automatically processed with correct VAT amounts, clients can receive their refunds faster, improving their cash flow and of course, their happiness! A survey by Deloitte found that businesses using automated AP solutions saw a 30% improvement in their tax compliance processes, leading to faster and more accurate VAT returns. The ROI is pretty clear to see here!

6. Enhancements To Your Practice

Partnering with an AP automation provider like Lightyear not only benefits your clients but also your practice. By adopting AP automation internally, you gain proficiency in using the software, enhancing your ability to support and advise clients on automated processes. This allows you to automate tedious tasks, create cost savings, and focus on enhancing other areas of your practice offering.

“With the offering of AP automation, we are able to offer our services to a wider range of businesses.”

- Thorne Widgery, Business Advisors & Chartered Accountants

Final Thoughts

Discover how much can be saved with Lightyear

Incorporating AP automation provides substantial ROI for both your clients and your practice. By reducing administrative burdens, minimising errors, speeding up processes, and improving financial visibility, AP automation enables more strategic decision-making and enhances overall efficiency.

Use our savings calculator to get an in idea of how much can be saved with AP Automation