As a finance professional, it can be overwhelming choosing from the many accounts payable apps available. They all promise to streamline your processes, reduce your costs and make your team work more efficiently. But how do you know which piece of tech is your match made in app heaven?

According to Capterra, “The wrong software is worse than no software” - 73% of businesses didn’t get a solution that matched their needs, costing more money and time wasted in the long run. Making the wrong decision can cause a few headaches for your team; missing features, extra workarounds, or additional training are all reasons to ensure you get an app that meets or exceeds your requirements.

Introducing a business expenditure app that incorporates accounts payable, purchasing and expenses will help support all areas of the spending process. Use our guide to give you confidence when navigating the app ecosystem.

Why choose a single app with a core feature stack?

What is a core feature stack?

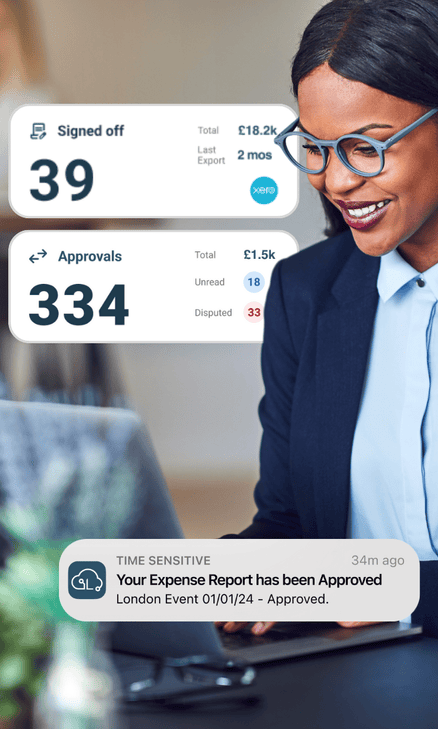

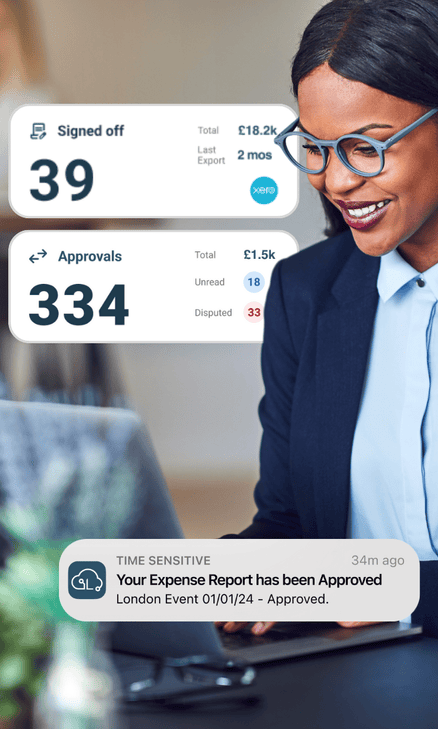

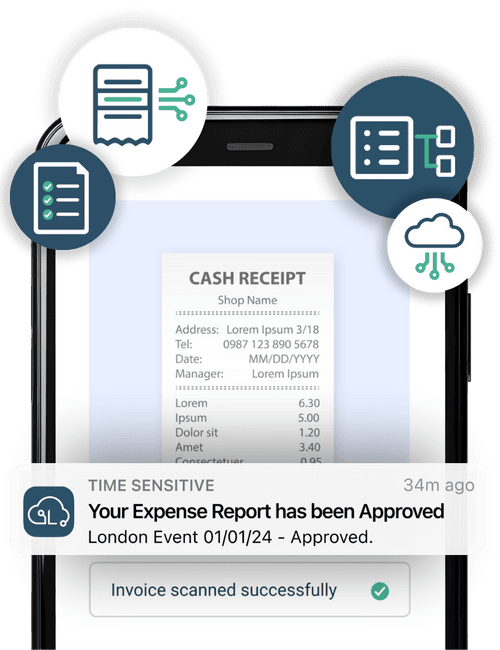

Business expense apps or any financial technology, give you access to a core set of features or modules. These form the essential functionality of the app. Each feature enhances existing financial processes to achieve the overall departmental objective.

Expenditure apps feed into world-leading accountancy solutions to facilitate financial automation, improve reporting and reduce manual processing errors.

Business expenditure apps combine data extraction, approvals, purchasing, expense management, and reporting in one app, eliminating the need for multiple apps. 70-90% of SMEs use multiple apps to manage their spending including procurement, accounting, expenses and reporting. This is inefficient, and it can be difficult to have them share relevant data.

The benefits of an all-in-one solution

Using an all-in-one business expense app can boost your profits and efficiency. These include:

Cost-effective: You are paying for one app rather than several.

Consolidated support: Single support team to contact regarding multiple features versus numerous for each app.

Data visibility allows modules and features to easily share data. This provides a clear overview and eliminates the need for multiple apps to communicate with each other.

Training of staff: A single app that harnesses multiple functionalities is easier to train staff on compared to training on various apps with different customer interface harnesses multiple functionalities is easier to train staff on compared to training on various apps with different customer interfaces

Selecting the right all-in-one solution

Understand your requirements before shortlisting apps

Understand your requirements before shortlisting apps

Before you jump into shortlisting your favourite bunch of apps, understanding your fundamental needs is essential. Taking the time to identify problem areas, shortfalls or gaps in processes will pay off when choosing the app for you.

Areas to think about:

1

Which parts of the spending process do you need the app to cover? Does your team cover purchasing, data entry, approval workflows, bookkeeping, employee expenses, filing, or reporting?

2

Does each area need to share data easily? Do you want a seamless integration into your accountancy solution?

3

Think of nice-to-have’s. Is your department going to consume for areas of the finance function? Is your team or company planning to grow? This ensures the app is scalable as you develop.

Webinar Recording

Watch the Expenses Launch Webinar

Recap on our Expense Management launch webinar which takes you through the feature's mobile and desktop's capabilities.

Put your team first

Put your team first

Your team are the backbone of the finance department. Bringing them on the journey is essential to ensuring you select the right app. Change can be daunting, but asking questions and taking on feedback can make the process easier for everyone. Evaluate your team and think about:

The level of technical competency of individuals. How complex can the system be? How much training will be required? This will help you understand the level of ongoing support you require from your provider. Do they provide 24/7 support? Are there online resources? What means of contact are available?

What areas are they most struggling with? Is it time spent on manual tasks? Is there a lack of visibility across all spending areas? Are they struggling to consolidate data in one place? Are suppliers or employees being reimbursed on time? Identifying areas of concern will help you determine your focus on feature requirements.

What are the current ways of working? Do these need to be revised to help achieve goals? Do these apps align with company processes? Think about enhancing current processes rather than changing them to avoid pushback from staff.

Making the strategic decision to integrate an all-in-one business expenditure app will enhance your financial processes and help reduce your team's workload and stress. The benefits of an all-in-one app enable you to save money, consolidate data, and ensure successful adoption.

Knowing the questions to ask is important in selecting the right app. Understanding your business requirements and future goals helps determine the functionality you need. Considering your staff when making the decision ensures successful integration in the long run.

Key Takeaways

1

An all-in-one app compared to multiple apps saves you money, consolidates data and increases adoption

2

Take time to understand your departmental requirements and overall business goals

3

Asking the right questions and taking feedback onboard from staff helps with a successful integration

Additional Resources

Implementation eBook

Get started on your journey to AP automation with our step-by-step implementation guide