The UK’s Spring Budget 2025 outlines key measures to drive economic growth, reform welfare, and strengthen national security.

While the Chancellor kept her promise of no tax surprises, your business may still face financial pressures. The OBR forecasts CPI inflation to average 3.2% in 2025 before dropping to 2.1% in 2026 and reaching 2% by 2027. This means rising costs will continue to impact pricing, wages, and operations.

So, how will your businesses navigate the UK government’s strategy to tackle fiscal rules and support development? With tighter tax regulations and the shift in spending patterns, it may be time to embrace automation to ensure profitability and maintain compliance.

Let’s take a closer look.

Economic Growth & National Living Wage

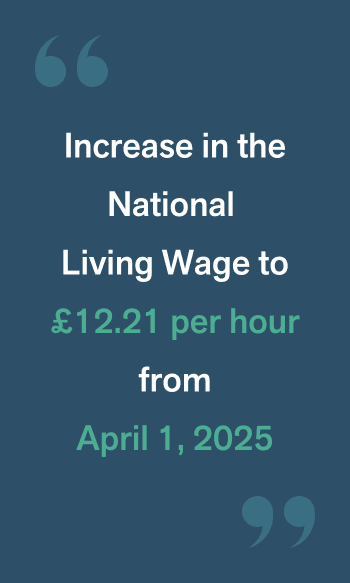

Although there are no tax increases, the spring budget states that economic growth forecasts have been revised down from 2% to 1% for 2025. Additionally, with an inflation forecast of 3.2% and the increase in the National Living Wage, which will provide a pay rise for 3 million workers starting on April 1, 2025, these factors reflect the ongoing cost pressures faced by various industries.

What does this mean for your business?

Lower Consumer and Business Demand - With GDP growth slowing, you may see a dip in consumer spending and overall demand. This means it’s time to reassess your sales forecasts, adjust budgets, and ensure you have a strong cash flow strategy in place to stay ahead.

Higher Labour Costs – If your business employs minimum-wage workers, your payroll expenses are about to rise. This means you’ll need to review your budgets and find ways to offset these additional costs without sacrificing profitability. One way to stay ahead is by automating your processes; cutting unnecessary admin time, reducing manual errors, and optimising cash flow, allowing your team to focus on more valuable work. This keeps your operations efficient, improves job satisfaction, and helps you manage wage increases without cutting into profitability.

Pricing & Supplier Adjustments – With rising wages, you’ll likely see price increases from suppliers, too. Now is the time to review your contracts, assess spending, and negotiate better deals to protect your margins. Look for early payment discounts, bulk purchase agreements, or alternative suppliers to keep costs in check. Use automation to get real-time spending insights so you can make smarter decisions when renegotiating contracts.

Tax Compliance and Avoidance

As the government builds efforts to tackle tax evasion with new measures designed to close loopholes and strengthen enforcement, their push for stricter enforcement aligns with the UK’s Making Tax Digital (MTD) initiative.

Chancellor Rachel Reeves announced increased investment in cutting-edge technology and HMRC resources to crack down on tax avoidance. The goal? A 20% increase in tax fraud prosecutions each year. These changes are expected to raise an additional £1 billion by the end of the year, bringing the total revenue from anti-evasion measures to £7.5 billion.

What does this mean for your business?

Audit-Ready Finance Operations - With the HMRC cracking down on tax fraud, transparency in your finance operations is more important than ever. AP automation creates a clear, traceable record of every transaction, making audits faster and stress-free while reducing the risk of compliance issues.

Tighter tax review processes – MTD requires your business to maintain and submit digital records, and automation makes this seamless. By automatically capturing, storing, and reporting invoice data, you eliminate manual errors and ensure VAT calculations are always correct.

Staying informed – Tax laws evolve, and falling behind could result in unexpected liabilities. By integrating an intelligent automation solution, you ensure compliance without the constant worry of keeping up with every change because your system does it for you.

Trusted by 7,500+ businesses globally

Servicing businesses is what we do best. We have over a decade of experience working with businesses just like yours. We've helped finance teams reduce their invoice processing by up to 97% and get invoices approved 5 times faster

Read our customer success stories to see the data for yourself

Defence and Security Investments

Defence and Security Investments

The government is investing in the future by allocating at least 10% of the Ministry of Defence’s equipment budget to cutting-edge technologies like AI and drones. At the same time, economic policies are expected to boost real GDP by 0.6% over the next decade, with the average person seeing an increase of over £500 per year in disposable income.

What Does This Mean for Your Business?

Opportunities in Tech & Defence – With the government pouring money into AI and drone technologies, there’s an exciting opportunity for businesses in the tech, defence, and manufacturing sectors. If your business is involved in these industries, expect a surge in demand and the potential for lucrative government contracts.

Economic Growth & Consumer Spending – The predicted 0.6% GDP increase over the next decade signals steady economic improvement, but don’t expect instant results. Yes, higher living standards could boost consumer spending, but rising inflation and wage pressures might balance out the benefits in the short term. Stay alert and adapt to the pace of change!

Embrace Automation & Innovation – The rise of AI and government investment in innovative technologies is a signal for businesses to do the same. By adopting tools like AP automation, your business can stay ahead of the curve and drive efficiency, even in challenging economic times. In other words, now’s the time to invest in automation to future-proof your operations and keep things running smoothly.

Final Thoughts

Final Thoughts

Other resources

EBOOK

Download our '5 Steps to Automating Your AP Function' eBook for quick and actionable tips on a smooth implementation process.

LIVE WEBINARS

Join our live webinar to see how Lightyear works to enhance AP processes across your business.

Join our live webinar to see how Lightyear works to enhance AP processes across your business.