A CFO's Guide To Leveraging Automation For Long Term Success

It’s no secret that the role of the CFO has evolved over the last few years; no longer are they limited to overseeing financial management and reporting activity. Now, they must balance shareholder, employee, customer, and overall company needs while navigating an everchanging and often hostile environment. As a result, CFOs must be agile, flexible, and responsive to ensure the continued growth of the company. This evolutionary approach is in juxtaposition with the traditionally risk-averse nature of the CFO.

In this blog, we will discuss how CFOs can leverage finance transformation to embrace boldness, unlock value for their teams and drive success across their business. These insights will help CFOs reframe the future of their business via prioritisation of the development of digitised finance functions, hiring new talent, changing their mindsets regarding risk aversion, and automating finance functions.

Prioritising Data

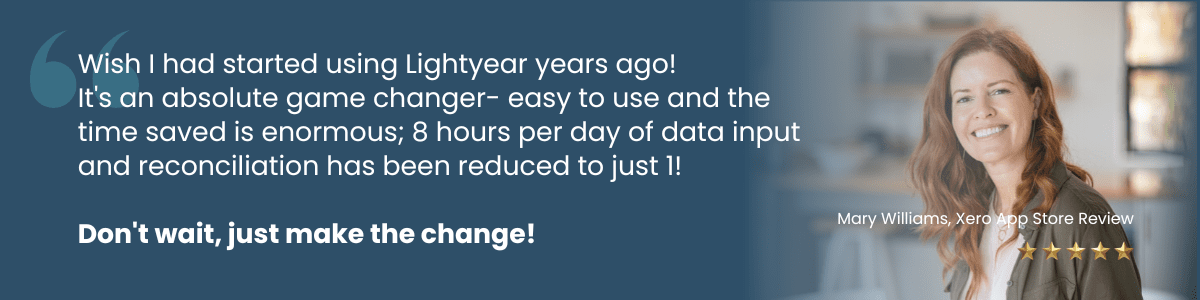

According to a 2023 Gartner report CFOs are prioritising the development of digitised finance functions to drive sustainable, long-term growth. This means that to succeed, the finance function should be able to effectively process, analyse and visualise large amounts of data from a wide range of sources at a rapid pace. In other words, the previous ways of 'death by spreadsheet' and manual entry are no longer profitable and should be replaced with finance automation technologies.

One of the most significant benefits of finance automation technology is its power to provide CFOs and their teams with real-time, accurate data. These insights are critical because they inform vital decisions and allow the CFO to pivot quickly to changes in the financial environment that wouldn't have been possible with manual functions.

Automation is King

Automation is King

Finance functions are best positioned to drive value when they free up time and money spent on routine activities - Dave Helmer, EY Global Tax and Finance Operate Leader

In other words, automation is king, and the key to success is partnering with the right automation solution for your business. According to Gartner, 94% of CFOs have ambitions for digital growth in 2023 and when the burden of time-consuming and repetitive accounting tasks are removed by automation, CFOs can truly make the most out of their team's manpower.

Bold finance automation is an opportunity for CFOs, by analysing large amounts of data across their entire finance functions in real time, automation technologies can inform current and future cash balances and flows. With this data, they can predict potential cash flow problems before they present themselves enabling for much better budget controls.

The Mindset Shift

The Mindset Shift

One of the biggest blockers to long-term sustainable growth is mindset. Traditional CFOs typically started in either auditing or accounting functions, which by nature are much more about risk avoidance and compliance rather than bold transformation. However, with the role of the CFO evolving to a more ambitious way of leading the finance function, there is a need to embrace automation and a more human-centric approach to succeed.

Left-sided, risk-averse thinking is still important, but it must be balanced against sub-optimisation and incremental change. For example, a large part of the CFOs role is to provide reliable and accurate first-time deliverables like financial statements. It is important to note that while reliability is important, it can lead to an unwillingness to innovate and a tendency to simply revise previous processes without evaluating if they actually bring any value. Risk awareness should be balanced with the desire to encourage innovation.

CFOs must balance innovation and risk to move away from survival tactics by developing effective working capital plans that can drive sustainable growth while enabling them to weather inflation and supply chain disruptions. However, pivoting from a risk-averse mindset is not about taking any and all risks, it’s about taking the right risks - remember, “without risk, there is no reward”.