I’ve spent years in finance and understand why Excel has become a go-to tool.

As the CFO at Lightyear, I’ve seen firsthand how effective Excel can be. It’s long been the backbone of my finance team and teams around the world. It’s flexible, familiar, and incredibly powerful in the right hands. In fact, 90% of CFOs still rely on Excel to manage their key financial processes.

But I noticed that as my businesses grew, so did the demands on our finance function. And while Excel still remains useful, it’s no longer enough on its own. The other day, I came across a statistic that said nearly half of CFOs admit they need better tools for financial forecasting and reporting.

If you're feeling the same pressure, you're not alone. It might be time to rethink your reliance on spreadsheets, especially when it comes to accounts payable (AP).

In this article, I’ll walk you through 4 clear signs that it’s time for you to move away from Excel and upgrade to AP automation.

Your Bill Volume Is Growing

Your first sign to upgrade to an automated AP is your growing invoice volume.

I remember speaking to a finance lead at a mid-sized business who was trying to keep up with their growing invoice volume using Excel. At first, it worked fine for them, but then the invoices became harder to track.

The AP Manager told me their team was dealing with frequent data entry mistakes, which delayed approvals and held up payments to suppliers. That’s what pushed him to start exploring AP automation.

However, he was initially hesitant, thinking it only worked with the big-name ERPs, which wasn’t what they had in place. They thought automation was only for companies with sophisticated systems.

But the reality is that because AP automation tools integrate with so many different types of software, they didn’t need to overhaul their setup. I told them, ‘You can plug this into what you’re already using and still get all the benefits like accuracy, efficiency, and consistency in how invoices are handled.’ And they did. It completely changed the way their team worked.

I’ve seen this happen time and again, and no matter the size of the business, once they make the switch, they wonder how they ever managed without it.

Your Approval Delays Are Difficult

Honestly, AP automation is something I wish I’d had 20 years ago.

Having worked in finance for over 30 years, I’ve seen how chaotic approval workflows can become, especially when dealing with high volumes of invoices across multiple departments.

In some of the companies I worked for previously, we had an entire person whose sole job was chasing down approvals, cross-checking invoices with purchase orders, and manually matching them all. It was so time-consuming that I often felt frustrated.

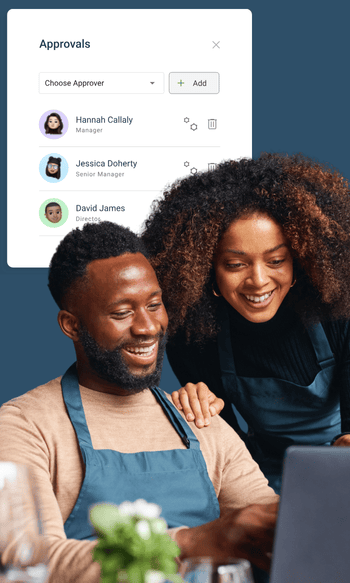

When I joined a company that had AP automation in place, that stress disappeared. The system knows who needs to approve what based on rules I set once. Now, whether there are 10 documents to approve or 100, I get an automatic notification.

My team does not have to chase me, and I do not have to chase anyone else for approval. More importantly, it keeps a clean record of every action taken. That kind of traceability is gold when I am running audits or trying to resolve disputes.

If I’d had that sort of visibility and control 20 years back, we would’ve saved so much time and avoided so many bottlenecks.

You Need Role-based Access

You Need Role-based Access

This third sign to upgrade is one I’ve learned the hard way.

I have an Excel spreadsheet in my system that the CEO and I share. However, sometimes, I make changes to it, and he does not understand why, and vice versa. We're essentially using it in slightly different ways for the same task.

When you open an Excel sheet to multiple users, the logic, formatting, and regular workflows that you rely on can easily be overwritten or distorted, especially if others are using it differently.

Excel does many things well, but it falls short when it comes to managing user access and responsibilities. You can lock cells or protect sheets, but you can’t truly assign roles like viewer, approver, or admin within the file itself. This means anyone with access can see or change more than they should, which introduces significant risks to data integrity and compliance.

AP automation has solved this problem for us. I can now assign permissions based on job roles so approvers only see what’s relevant to their department, while admins can manage users and workflows. It’s given us far more control and has drastically reduced the chances of unauthorised access or costly errors.

The best part for a growing business like ours is that every user action, whether approving, editing or rejecting, is time-stamped and recorded, giving us full traceability and accountability. AP automation offers us control and visibility, and it’s exactly what I needed to stay compliant as we scale.

Trusted by 7,500+ businesses globally

Servicing businesses is what we do best. We have over a decade of experience working with businesses just like yours. We've helped finance teams reduce their invoice processing by up to 97% and get invoices approved 5 times faster

Read our customer success stories to see the data for yourself

You Are Rethinking AP Headcount

You Are Rethinking AP Headcount

I remember working in a company where we’d implemented an ERP system, and the owner pulled me aside one day and said, 'I don’t understand why I’ve got twice as many people in Purchase Ledger as I do in Credit Control. Why am I spending more resources on paying people than I am on getting paid?'

From a finance perspective, I understood it: direct debits mostly managed their income, so there wasn’t a big need for credit control staff. But his point really stuck with me. He was questioning the imbalance, and it made me realise how much manual effort we were still throwing at AP.

That’s where automation comes in. That conversation really shaped how I think about AP automation today: it’s not just about efficiency, it’s about rebalancing where my team add the most value.

If you’ve got a smart way of getting invoices into the system without the constant human input, then your whole workload shrinks. You don’t need to keep building out the AP team just to keep up with the volume, but redirect their focus to more strategic tasks.

Final Thoughts

Final Thoughts

It got to a point where I knew that we had to focus more on automation for AP than Excel. And we weren’t the only ones feeling it. So many of our clients were in the same boat.

What I’ve seen, both in my own team and with our customers, is that this isn’t just a technology upgrade. It’s a step change in how finance operates: smarter, stronger, and ready to scale.

Lorna Ervine

Chief Financial Officer

Lightyear

Other resources

EBOOK

Download our 5 Steps to Automating Your AP Function eBook for quick and actionable tips on a smooth implementation.

LIVE WEBINARS

Join our live webinar to see how Lightyear works to enhance AP processes across your business

Join our live webinar to see how Lightyear works to enhance AP processes across your business