Top tips on how to streamline processes for your clients or finance teams

Automation in Finance: AP Control and Smarter Finance Decisions

Read article on Automation in Finance: AP Control and Smarter Finance Decisions

Centralise Communication With AP Automation Solution

Read article on Centralise Communication With AP Automation Solution

Beyond the Basics: Your End-to-End AP Automation Questions Answered

Read article on Beyond the Basics: Your End-to-End AP Automation Questions Answered

The Advantages of AP Automation and ERP Integration

Read article on The Advantages of AP Automation and ERP Integration

Reduce Decision Fatigue with Automated Coding

Read article on Reduce Decision Fatigue with Automated Coding

The Hospitality Tax: 4 Reasons Your Manual AP Costs More Than It Should

Read article on The Hospitality Tax: 4 Reasons Your Manual AP Costs More Than It Should

How AP Automation Reduces Staff Overheads in UK Hospitality Finance

Read article on How AP Automation Reduces Staff Overheads in UK Hospitality Finance

Remove AP Approval Bottlenecks with Mobile Invoice Approval App

Read article on Remove AP Approval Bottlenecks with Mobile Invoice Approval App

Autumn Budget: A Hospitality Business Guide for 2026

Read article on Autumn Budget: A Hospitality Business Guide for 2026

Why Businesses Choose Lightyear As Their Hospitality Automation Software

Read article on Why Businesses Choose Lightyear As Their Hospitality Automation Software

How AP Automation Helps AU Hospitality Businesses Control Spend

Read article on How AP Automation Helps AU Hospitality Businesses Control Spend

Your Ultimate Guide to Accounts Payable Automation

Read article on Your Ultimate Guide to Accounts Payable Automation

Why CFOs Are Turning to Intelligent Accounts Payable?

Read article on Why CFOs Are Turning to Intelligent Accounts Payable?

Why Keyword Approvals Are the Next Evolution in AP Automation

Read article on Why Keyword Approvals Are the Next Evolution in AP Automation

Role of AP Automation in Cybersecurity

Read article on Role of AP Automation in Cybersecurity

Invoice Dispute Management Using AP Automation

Read article on Invoice Dispute Management Using AP Automation

Improved AP with Automated Supplier Statement Reconciliation

Read article on Improved AP with Automated Supplier Statement Reconciliation

The Automation Advantage: Fueling Accounts Payable Success in 2024

Read article on The Automation Advantage: Fueling Accounts Payable Success in 2024

Strategic Rollout Plan for AP Software Implementation Success

Read article on Strategic Rollout Plan for AP Software Implementation Success

Rethinking Recruitment: Automation In Finance Departments

Read article on Rethinking Recruitment: Automation In Finance Departments

4 ways to gain buy-in when automating your AP function

Read article on 4 ways to gain buy-in when automating your AP function

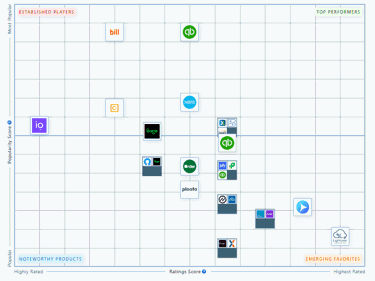

Lightyear shortlisted in Capterra Report for Accounts Payable Software

Read article on Lightyear shortlisted in Capterra Report for Accounts Payable Software

3 Ways to improve your Accounts Payable Process

Read article on 3 Ways to improve your Accounts Payable Process

3 Building Blocks for a Seamless AP Software Transition

Read article on 3 Building Blocks for a Seamless AP Software Transition

How AP Automation Supports Accounts Payable Audit Trail

Read article on How AP Automation Supports Accounts Payable Audit Trail

5 Benefits of AP Invoice Approval Software

Read article on 5 Benefits of AP Invoice Approval Software

How AP Automation Simplifies Matching Invoices to Purchase Orders?

Read article on How AP Automation Simplifies Matching Invoices to Purchase Orders?

How to Improve Cash Flow in Construction with Automated AP

Read article on How to Improve Cash Flow in Construction with Automated AP

Why Automated Accounts Payable Is a Game-Changer for Your Clients

Read article on Why Automated Accounts Payable Is a Game-Changer for Your Clients