Identifying The Need For Accounts Payable Automation: Sage 50 / 200 Users

The Sage 50/200 products stand as trusted companions for finance teams, and rightly so - they're a reliable, robust piece of kit. And so, you're adept at navigating your Sage 50 or 200, it's doing the job and things seem good, albeit a little manual in parts.

But here’s the catch: In a world where efficiency and accuracy is paramount, every minute spent on manual processes, especially those that need not be manual, is a minute lost to strategic decision-making and added value activities. So what if we told you there's a way to elevate your efficiency without overhauling your entire finance process?

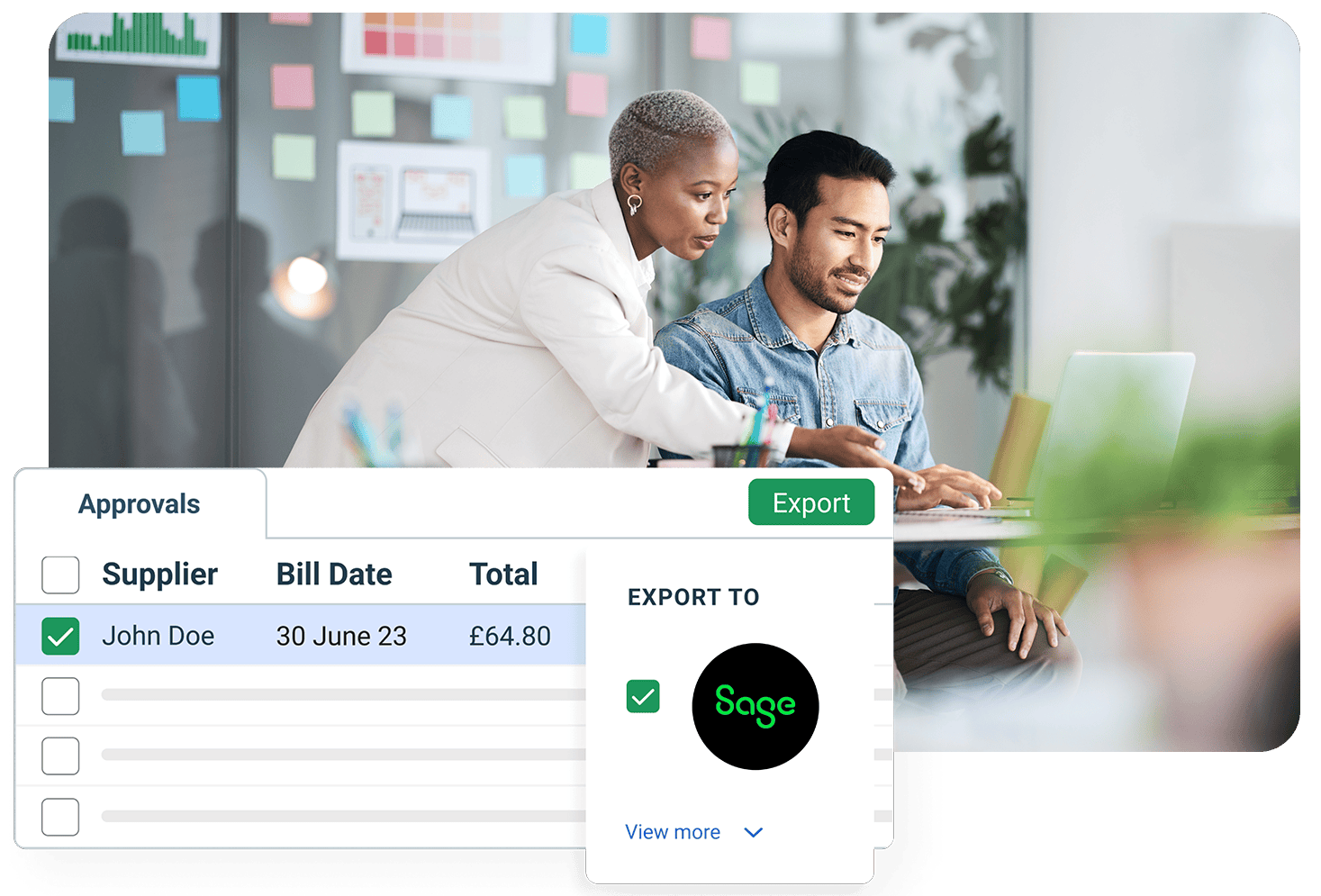

Enter AP automation.

Accounts payable automation is an easy way of adapting some elements of the finance function. It takes your current purchasing and payable processes and digitises them, meaning that vendor invoice activities are streamlined and enhanced. It’s a change that leads to safer, more efficient, and cost-effective AP operations. Automation in this one area can have a profound knock-on-effect on the accounting workflow (and entire business!).

Here are 5 signs which indicate that accounts payable automation could be an opportunity for you to give your process a not-so-little lift.

1. You're drowning in paperwork

Are you swimming in a sea of paperwork, battling the tide of lost AP documents or feeling overwhelmed by filing cabinets? Too much paper can be a challenge, especially when the time comes for audit or remote work means that paperwork is literally out of reach. If your purchasing or AP processes are paper-based, you may find that things go missing, get delayed, or that you lack visibility on spend. Add in multiple entities and these issues are multiplied.

Automated invoice processing can help you gain control over your AP processes, leaving you on the front foot when it comes to doing your work in Sage 50 or Sage 200.

2. Manual processes are taking their toll

3. The perils of staff turnover

When experienced employees depart, you may lose their specific knowledge, access to historical data, and inherent understanding of business processes... they always knew exactly what to do with that particularly tricky invoice from that one random supplier.

According to the Spotlight Global Trends Advisory Report, hiring and retaining talent remains the number one challenge for finance teams in 23/24. If this resonates with you, rather than trying to squeeze the gold out of your leaving employees so you can get new staff up to speed, why not fix the root cause instead?

Implementing an intelligent AP solution allows you to train the software to understand your niche processes, creating a scalable and sustainable way of working.

4. Reporting blind spots

5. You're thinking "there must be a better way"